Focus

From basic research to commercialization

In close collaboration with Kyoto University, other Japan's national Universityies and other stakeholders,

we provide hands-on with proactive support for them to make the transition from basic research to commercialization relatively easily.

Our support to start-ups includes the following:

*Researchers who would like to discuss entrepreneurship, or have questions about investment, please let us know using the contact form.

Consultation on company establishment / Search for management personnel / Introduction and matching of Kyoto University research results / Support for preparation of business plans and capital policies / Management support by dispatching outside directors, etc.

Finance support through introductions to private VC and financial institutions / Support for developing suppliers and sales partners / Introduction of advisors for IP, legal, accounting, and taxation matters / Support for developing strategic alliances and EXIT partners / Support for M&A and IPO preparations, etc.

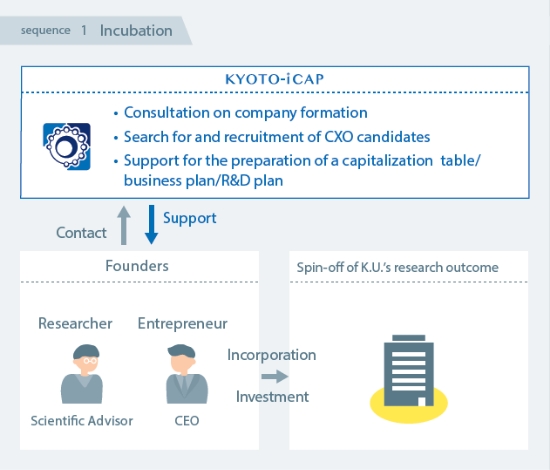

Investment in a spin-off of Japan's national University’s research outcome

This is a case in which a researcher alone or a researcher and an entrepreneur proceed to establish a venture company based on the results of Japan's national University’s research. Kyoto-iCAP provides consultation on the establishment of the company, searches for management personnel, and supports the preparation of a business plan and capital policy, etc., before investing capital after the company is established. In such cases, Kyoto-iCAP dispatches outside directors and provides financial support through introductions to private VCs.

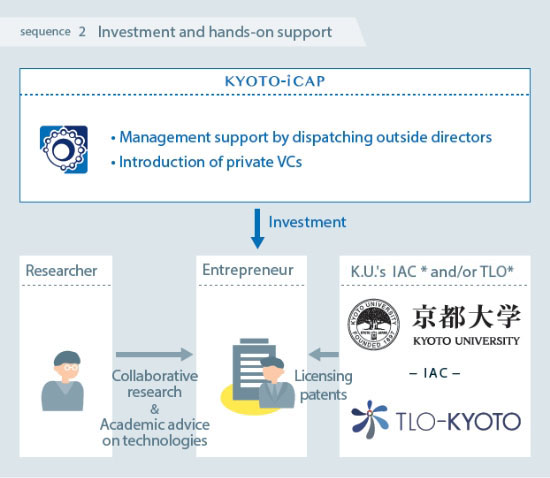

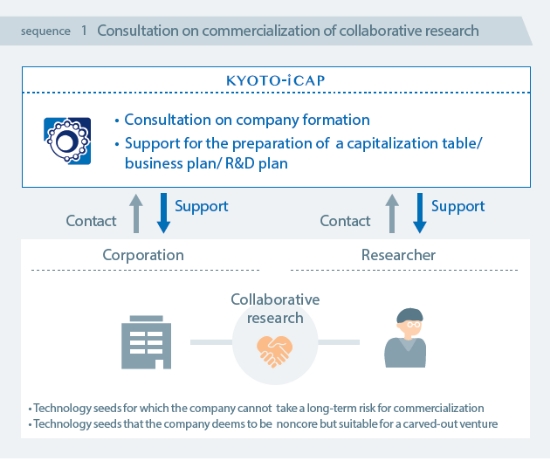

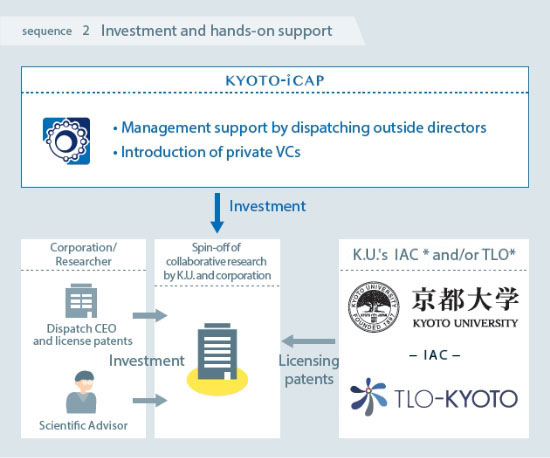

Investment in a spin-off of collaborative research by Japan's national Universities and corporation

This is a case in which Japan's national Universities and a company are proceeding with the establishment of a venture based on joint research. Kyoto-iCAP provides consultation on the establishment of the venture, support for the preparation of a business plan and capital policy, and other services, and then invests in the venture in the form of a joint venture with a company. In such cases, Kyoto-iCAP provides management support by dispatching outside directors and financial support by introducing private VCs.

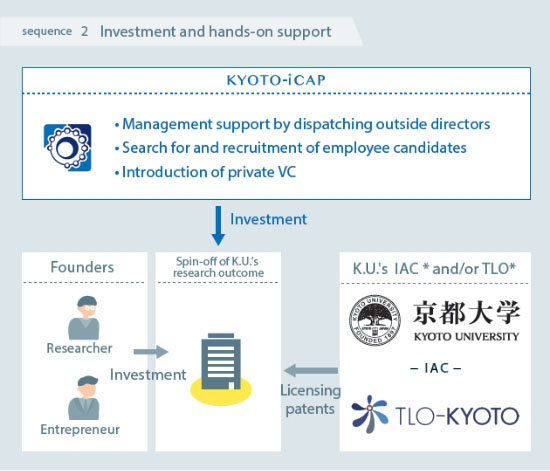

Investment in a start-up utilizing research outcomes of Japan's national Universities

This is a case in which Japan's national University’s research results are matched with venture companies that have technological issues, and capital is invested in venture companies that utilize Japan's national University’s knowledge. The investment is made after determining that the use of research results will promote the growth of the venture company, that it is expected to create new social value, and that the use of the results will contribute to the advancement of academic research.

In such cases, we will dispatch outside directors and provide financial support through introductions to private VC firms.

In such cases, we will dispatch outside directors and provide financial support through introductions to private VC firms.